As the dust settles on another financial year, it’s not uncommon to reflect on the challenges and successes that have taken place. Our team has been reviewing support calls and STP (Single Touch Payroll) lodgements throughout the end of the financial year period, and we have identified some common errors people are experiencing. These errors can be easily rectified with a little know-how, and we want to share that with you. Our aim is to provide practical and valuable support, so that you can confidently navigate your financial obligations and ensure compliance with the relevant regulations. So, let’s dive in and discover how you can quickly and efficiently resolve some of these common issues.

ATO STP Error – Cessation Reasons Must be Provided

We occasionally see this error during the year when an employee is terminated. As all employees, both active and terminated, are included in end of year finalisations, this error will resurface if not addressed. There are two possible causes of this error:

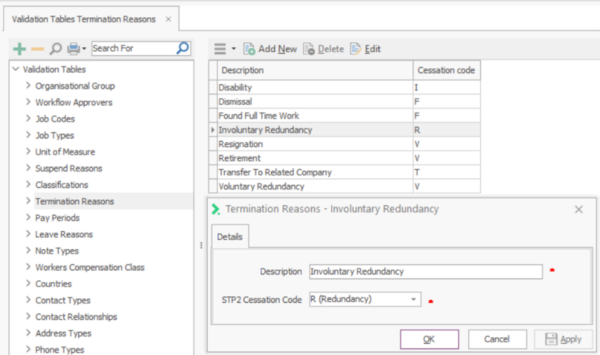

#1 ATO Cessation Codes have not been set in the companies Validation Tables.

To fix this you need to navigate to Validation Table, Termination Reasons and then ensure that all reasons have a Cessation Code listed against them.

If there are any with missing codes, double click to open up the reason and the specify which ATO STP2 Cessation Code should apply to that Termination Reason.

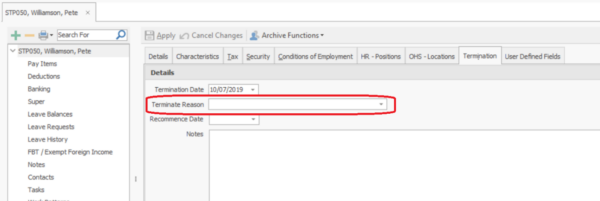

#2 You have not entered the termination reason on the employee record.

This is more frequent and occurs when you have entered in a Termination Date but have not provided a reason for the termination.

To fix this, you need to open the Employee, go to their Termination tab and then specify the Termination Reason.

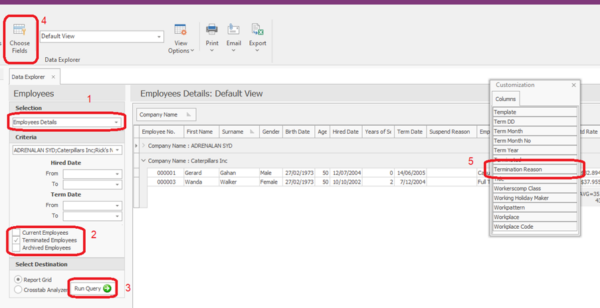

To help identify employees who may not have a reason you can use Data Explorer.

In Data Explorer choose Employees – Employee Details

Filter for Terminated Employees only and Run Query

If you have a large turn over you may choose to additionally filter for termination dates in the financial year. Then add the Termination Reason from the Field Chooser into the grid by dragging it from the list to a column heading.

For any employee with a termination date but no reason populated, drill in and update their reason.

STP2 Reconciliation Report Not Balancing – Allowances

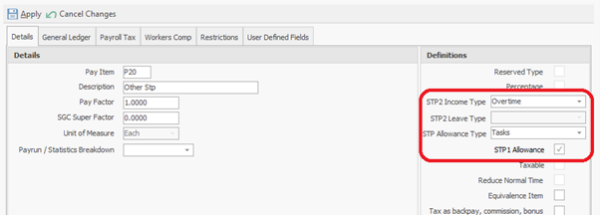

If you find the amounts reflected in the STP 2 Reconciliation Report not matching your Employee YTD Earnings Reconciliation, check your pay item configuration. We have seen some pay item configurations resulting in amounts being reported twice, under Non-Allowance STP2 Income Type as well as an STP2 Allowance Sub Type.

If you find that a pay item may be reported twice.

If you have a large number of pay items, you can run the Historical – Pay Item Total Report for the year from the Reports Explorer which breaks the details down by pay item to help identify any pay items that may be affected. The quickest way to clear the STP Allowance Type is to untick the STP1 Allowance tick box.

If you are unable to modify the pay item check:

- You are logged in with Administrative rights

- You do not currently have a pay run open

If you have checked both of these contact support for further assistance.

IMPORTANT: If you find this issue after you have finalised you should re-finalise to ensure the ATO has the updated figures.

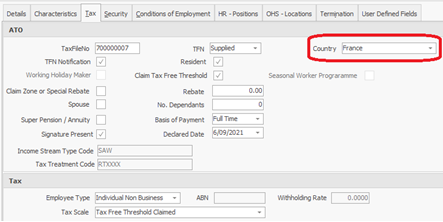

Working Holiday Maker – Country

If you have had a Working Holiday Maker (WHM) employee transition to a different visa during the year and become a standard Salary & Wage (SAW) employee, you need to keep their original WHM country selected on their employee tax tab.

We are seeing a number of STP rejections due to this being changed incorrectly to Australia. If you have an employee that has been processed as a SAW employee inform you at the end of the year they were a WHM. You should finalise the employee’s year as SAW. You should then update them to a WHM for the new year. It is not possible to finalise them as a WHM when they haven’t been paid as a WHM during the year.

Contractor Payments

We are seeing a number of lodgement errors with Contactors, Voluntary Agreements and Labour Hire individuals. These appear as ATO STP Errors referencing:

- Tax Treatment code DZXXXX

- Employment Type N

You should check the setup of the individual contractors to ensure they are configured correctly and/or need to be reported.

Individual Contractor – paying super only – Not required to lodge STP2 as such currently excluded from Finalisation Update events.

Payments to a contractor should be on a pay item that is set to “Not Reportable”. They are generally processed in a separate payroll than employees.

Voluntary Agreements – Similar to an individual contractor above but you have been requested to withhold PAYG on the individual’s behalf. Payments to a Voluntary Agreement Individual should be on a pay item that is set to “Gross” only and you MUST have the individuals ABN number recorded in HR3.

Labour Hire – Only for businesses that hire individuals out to other businesses. If you are engaging a labour hire company to fulfil staffing needs for your business, you do not need to report them in STP2 as the labour hire company does the individuals STP2 reporting.

Note: If an individual from one of the above contractor categories becomes an employee, you need to create a new employee record in HR3.

In conclusion, mistakes can be easily made when it comes to lodging your STP and managing your financial records. However, with the right knowledge and tools, these errors can be swiftly resolved. By taking note of the common errors discussed, you can save yourself valuable time and effort in the long run. As always, if you are ever in doubt or need further assistance, don’t hesitate to reach out to our support team who are always ready to help.