On Tuesday, 25 October 2022, Treasurer of Australia, Dr Jim Chalmers handed down the Mid-Year Federal Budget with updates to key economic forecasts. To complement the budget announcement, ReadyTech held a webinar on Thursday, 27 October to provide highlights and explore the impacts.

The highlights of the webinar and takeaways from the Budgent announcement include:

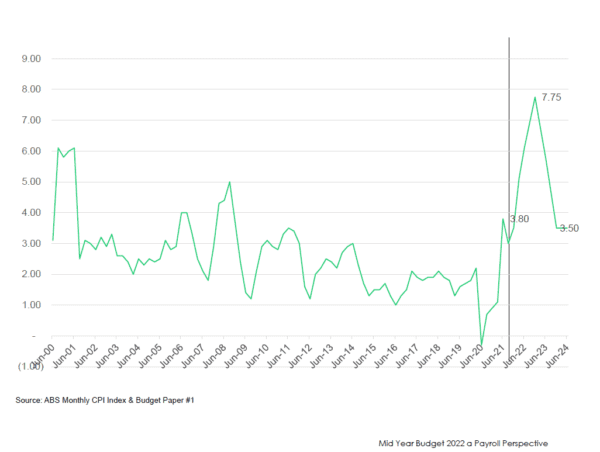

Inflation is expected to peak at 7.75% later this year, before over time, to 3.5%

What does this mean for businesses and their employees?

- Employees in the lower end of the pay scale may have to work multiple jobs to make ends meet

- Businesses who have difficulty finding employees will still face a hard road but this is expected to be easier compared to the last 6 months

- If your business is in an industry that can source skilled migrants, you may be a in a better position to fill staff gaps this way. In the latest budget announcement, the Government is investing to improve the visa processing times and they are providing 35,000 additional work visas for skilled migrants

- To remain competitive and retain valuable staff, businesses may be under pressure to increase their salaries

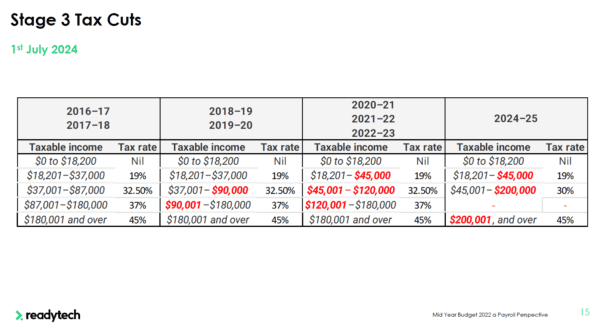

The controversial Stage 3 tax cuts are set to stay in place

The government is treating it like a hot potato. They don’t want to touch it because they don’t want to break election promises but the Government is getting heaps of pressure from the likes of the Green Party and other industry groups.

Low and Middle Income tax offset has expired

For those doing their tax returns for the last financial year, they can still claim the tax offset but for tax returns for 2023, this is not going to be available.

Pensioner income thresholds

The amount Pensioner’s will be able to earn before their pension is reduced will increase by $4,000. Originally $7,800, now going to be $11,800. This may allow you to offer some of your older employees more work without it having a negative impact on their benefits.

Paid Domestic Violence Leave

The new entitlement will be 10 days each year and the employees regardless of status (permanent or casual) are entitled to this leave from the start of their employment. Payroll software providers need some time build this into the platform as this leave entitlement is different from any other leave that accrues based on hours worked or for a specific period of time. The 10 days entitlement reset each year. For existing staff, the anniversary year is the date when the Leave Entitlement becomes available and for new employees, the Leave will reset on their employment anniversary.

We hope none of your staff should have a need for this but if they do, we need to make sure they get the support and leave to go help them through a difficult time in their life.

For this particular Leave, there are areas that still need to be clarified for payroll purposes, ie ‘What is a day’?

What does this new Leave mean for payroll people?

- Be ready to implement and learn how the new legislation will work as soon as you can

- Be careful how you communicate to employees around any of the areas of uncertainty

- Think carefully how you will manage casual rosters and an employee’s acceptance of a roster

Changes to Paid Parental Leave

Paid Parental Leave will increase by 2 weeks each year from 2024 to 2026 and will become more flexible between parents allowing them to take periods in blocks. This will require employers to adapt and the implementation will need to be monitored.

What does this mean to Payroll People?

- With the family income threshold increasing more employees will be able to take Paid Parental Leave.

- The ability for employees to take Paid Parental Leave in Blocks as little as a day will significantly change how businesses need to manage periods of Paid Parental Leave. A single full time maternity contract may become a thing of the past and Part-time or casual backfills may become the norm.

- Businesses providing additional Paid Parental Leave Schemes will need to review them and how they will work

Electric Vehicle FBT Changes (Proposed)

Electric Vehicles under the luxury car tax threshold ($84,916 for 2022-23) will be exempt from FBT and Import Tariffs. Vehicle must not have been held or used prior to 1st July 2022. An employer will still be required to report their employee’s reportable car fringe benefits in the employee’s reportable fringe benefits amount.

What does this mean to Payroll People?

- Novated leases for Electric Vehicle’s will become more attractive so more employees may enter into them.

- Existing Novated Leases may require adjustments to take into consideration the changes to FBT.

Salary Secrecy (Proposed)

The banning of pay secrecy clauses in employment contracts. This would remove the ability for employers to stop staff from discussing their salaries. This is key item in reducing gender pay discrimination which would empower women to request pay rises.

You can view the rest of the changes and watch the webinar recording in full below.

Did you know?

Did you know that ReadyTech Workforce Solutions has a configurable selection of cloud-based Payroll, HR and recruitment solutions to support your growing workforce? Check out our products and managed payroll services now.